Loans from £5,000 to £2,500,000

Poor credit & arrears accepted

Over 500 - 5 Star Reviews on Feefo

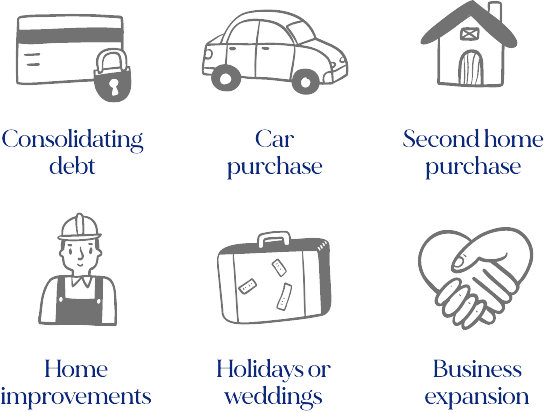

Typically, Secured Homeowner Loans are used for debt consolidation to lower your monthly outgoings, home improvements to add value to your home, weddings, cars, deposits for second homes. Our highly qualified team will tailor a solution to your circumstances.

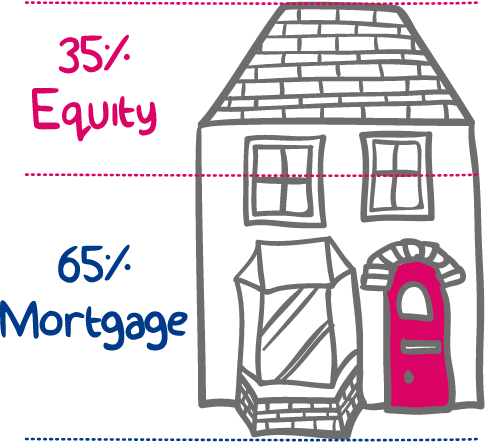

A secured loan is typically borrowed against the equity you have in your home.

You can legitimately use a Secured Loan against your home for any legal purpose. Whether it’s clearing debt, family holiday or getting your car fixed – all the below (and much more) can be secured against your home.

A Homeowner Loan allows you the flexibility that you may need, you can stretch the term to suit your budget and use the money for any legal purposes.

A secured loan, often referred to as a homeowner loan or 2nd charge mortgage, allow you to borrow large sums of money – typically more than £10,000 – using your home as collateral. Therefore, if you don’t keep up with the regular payments, the lender can take possession of your home and sell it to recoup their losses.

The amount you are eligible to borrow, the duration of the loan, and the interest rate you are offered will depend on your circumstances, as well as the amount of equity you have in your home. Equity is the difference between the value on your home and the amount left to pay on your mortgage if you have one. The interest can be variable or fixed depending on the type of loan you choose.

We’re based in the North West of England with a dedicated, experienced team of Secured Loan advisors helping homeowners across the United Kingdom. We have access to over 400 secured loans from the nations top lenders. We’ll match your individual circumstances to the right advisor who will source the best lender and ensure you get the correct deal.

We’re open 7 days a week, simply complete the form and one of our advisors will make contact and talk you through your options.

Matthew Edwards-Glasse

Training & Compliance Manager

Jonny Gallagher

Secured Loan Expert

Sheryl Jones

Head of Operations

Paul Foster

Customer Excellence Executive

Anthony Harrison-Duffy

Secured Loan Expert

Rhiannon Sturgess

Case Management Team Leader

Michelle Mills

Head of Secured Lending

Mel Wills

Case Manager

Chris Wheelton

Secured Loan Expert

Dave Graham

Head of New Business

Estelle Baker

Case Manager

Maddi Ali

Secured Loan Expert

Christian Moorcroft

Case Manager

Justin Adams

Case Manager

Jamie Palmer

Secured Loan Expert

Jordan Dowling

Secured Loan Expert

Ian Green

Secured Loan Expert

Kev Tilley

Founder and Managing Director

Mike O’Dwyer

Secured Loan Expert

Representative Example: If you borrow £20000 over 20 years. Initially, on a fixed rate for 5 years at 6.993% and for the remaining 15 years on the lender’s standard variable rate of 7.593%, you would make 60 monthly payments of £175.08 and 180 monthly payments of £9. The total amount of credit is £22595; the total repayable would be £43302.20 (this includes a Lender fee of £595 and a broker fee of £2000). The overall cost for comparison is 7.91% APRC representative.

Rates between 3.4% to 29.% APRC. Repayment terms between 3 and 30 years.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

Think carefully before securing other debts against your home

If you are thinking of consolidating existing borrowing you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.